Tax roll is a term you may have encountered when figuring out your property taxes. But what exactly is a tax roll, and why does it matter to the average homeowner? If you're wondering how this term factors in to your situation and real estate overall, here is a short guide to help:

What are tax rolls?

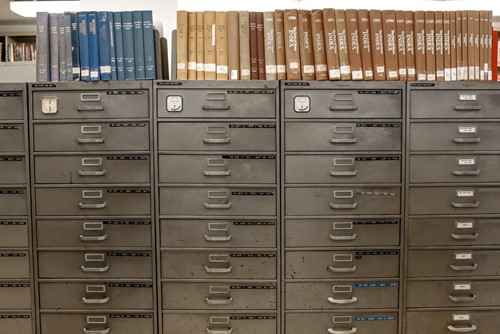

A tax roll is a list of all taxable properties in a specific area. Tax rolls are also called assessment rolls, and are maintained by the corresponding municipal government. There are usually multiple levels of tax roll, including local, county, state and national databases.

What are the different types of tax rolls?

The two main types of tax rolls are property tax rolls and motor vehicle tax rolls. There might also be separate rolls for tracking other types of taxable assets not fitting into either category.

Why are property tax rolls important?

Tax rolls are important for several reasons. They serve as an official record of property taxes in a given area and for specific properties. They contain detailed information about each property, including legal description, property classification, the assessed value of the land and improvements made, the individual ratepayer's contact information and owners code.

Having this information all in one place makes it easy to track variables like home values and corresponding tax obligations. It also means issues involving unpaid taxes can be spotted and dealt with accordingly by the local tax authorities. While property tax rolls may not be important during everyday life for most homeowners, they are important to understand when buying, selling or refinancing a property.

About the Author

ELLe B. WiLLson

Elle B. has enjoyed the splendor of Summit County since she was a child spending time at her family condo and skiing the fabulous Keystone slopes.